Iron ore’s slump likely to deepen until China’s economy revives

Iron ore is one the poorest performing commodities this year, and the rout in prices is only likely to deepen until China’s economy stages a revival.

Futures in Singapore have fallen for seven straight months, the worst run since the contract debuted in 2013. At around $81 a ton, the mineral costs about a third of its peak in May last year.

Futures in Singapore have fallen for seven straight months, the worst run since the contract debuted in 2013. At around $81 a ton, the mineral costs about a third of its peak in May last year.

China is by far the biggest buyer of iron ore, mainly from Australia and Brazil, to feed annual steel production that has topped 1 billion tons in the last two years. As such, it’s one of the defining raw materials of China’s economy, and a stalwart of a commodities boom that risks becoming a distant memory as the property market teeters and Beijing persists with its growth-crippling virus controls.

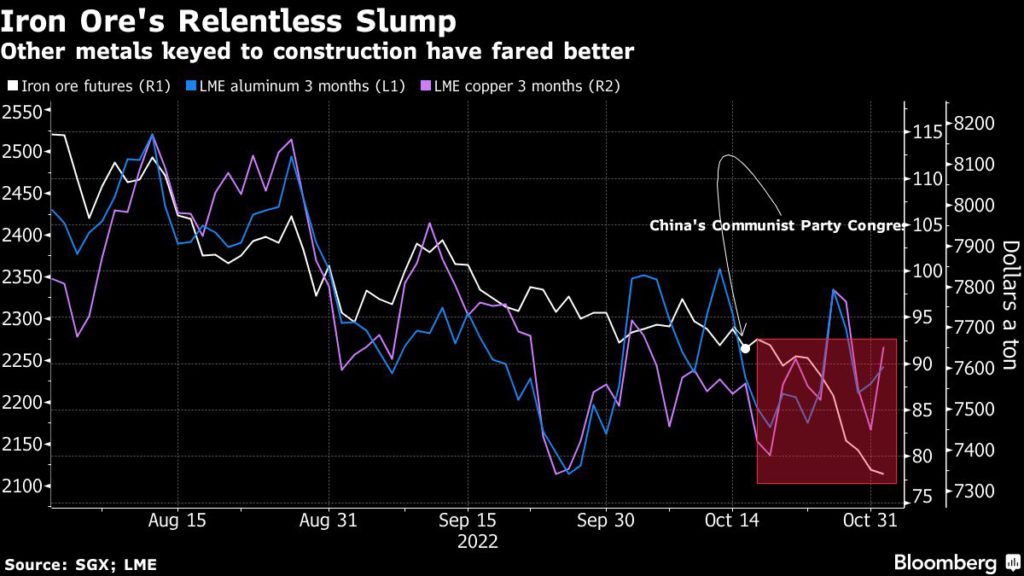

Hopes that conditions would improve in the autumn, the peak season for Chinese construction activity, were dashed by the end of the Communist Party Congress in October. The twice-a-decade meeting failed to deliver large-scale support for the real-estate sector, and didn’t chart a path out of the thicket of Covid Zero rules that have hobbled demand across commodities and disrupted operations from malls to factories and building sites.

“There is probably more downside ahead, as there is no clarity yet around the end of Covid lockdowns and no clear outline of economic measures to boost China’s economy,” said Gavin Wendt, founding director of Sydney-based MineLife Pty. That means tough times and margin pressures at steel mills are likely to continue, he said.

China’s steel industry has been warning of a crisis since the summer, and the third quarter saw major mills turn in their first aggregate loss since at least 2018, when Bloomberg began compiling data. They’ve tempered their purchases of iron ore in response.

Slowing global growth leaves little opportunity for steel mills to export their way out of trouble. Anti-pollution curbs on operations over the winter, and a government cap on annual steel output to limit carbon emissions, complete a bleak picture for demand over the next few months.

UBS AG estimates that daily steel production in China will fall by about 5% this quarter versus the September rate if the authorities enforce their target of lower annual production in 2022.

China’s property market accounts for 39% of its steel consumption, according to Gavekal Dragonomics. That sector has been in steep decline for over a year after Beijing stepped in to deflate what it feared was a bubble.

The situation isn’t getting any better, with sales at the top 100 developers plunging 28% last month. While government infrastructure spending to support the economy has offset some of the losses for steelmakers, the industry remains mired in contraction along with China’s broader manufacturing base, according to the latest survey of purchasing managers.

Iron ore’s steep drop contrasts with other metals used in construction, like copper and aluminum, which benefit from additional demand keyed to the energy transition away from fossil fuels. They’re also prone to supply squeezes. Copper has suffered from a lag in mining investment, while power shortages caused by heatwaves and the war in Ukraine have propped up aluminum.

Iron ore is a case apart. The big miners have been tremendously successful in lopping off costs in recent years and are under no great pressure to stem supply. Rio Tinto Group’s cost of production in the Pilbara, for example, is about $20 a ton, and its laser-like focus on efficiency meant it was still able to make money when iron ore futures hit a record low of $36 a ton in 2015.

Without any major reversals in Chinese policy, the expectation is that prices are likely to weaken from here. The latest forecasts from Citigroup Inc. and Goldman Sachs Group Inc. call for a drop to $70 a ton in three months.

Iron ore declined 0.3% to $80.30 a ton in Singapore as of 10:19 a.m. local time. Copper slipped 0.1% to $7,616 a ton on the London Metal Exchange, down for the fifth time in six sessions after the Federal Reserve’s hint it will raise rates higher-than-expected in coming months sapped risk appetite. Aluminum rose 0.8% to $2,268 a ton to be up for a fourth day.

Unverified social media posts earlier this week that suggested the government will assess how to exit Covid Zero have helped rally prices a little. Still, many remain skeptical that President Xi Jinping’s signature policy can easily be rolled back in just a few months, and if anything the excitement indicates a market that hinges almost entirely on what’s next from Beijing.

نظر: