Regulation rising as financial markets tackle climate risk

As the world recovers from the COVID-19 pandemic, while facing inflation, supply chain disruptions and war, investors, governments and international organizations need to remain focused on financial sustainable development goals, and climate change mitigation and adaptation, says UNCTAD’s World Investment Report 2022.

The Intergovernmental Panel on Climate Change has made clear that further rises in emissions after 2025 puts a 1.5°C warming scenario out of reach, increasing the physical risks from climate change, including droughts, floods and wildfires. Investors are also exposed to transition challenges resulting from regulatory changes.

According to the UNCTAD report, in response to climate, social and other sustainability risks, financial markets continued their pivot to sustainable finance in 2021.

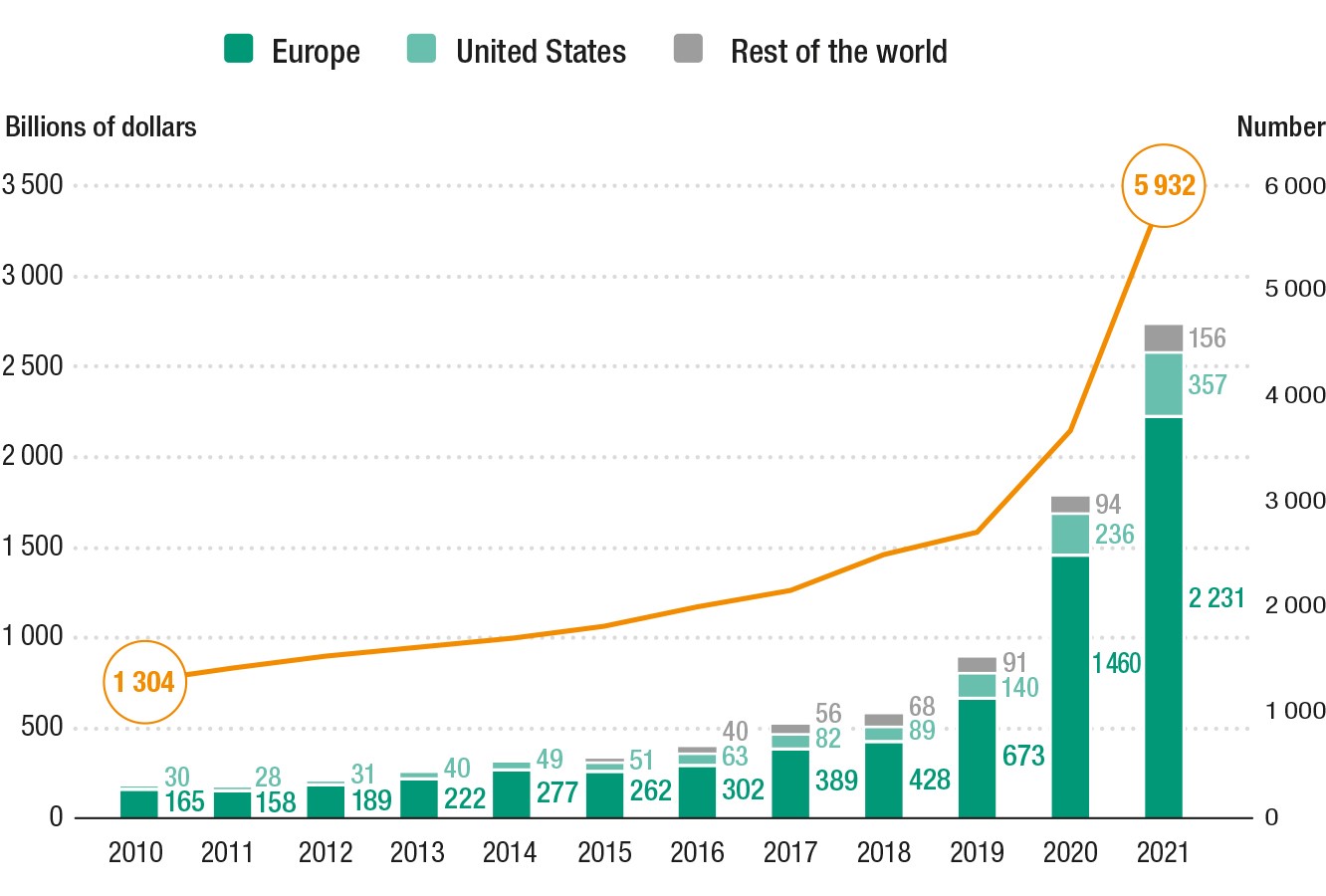

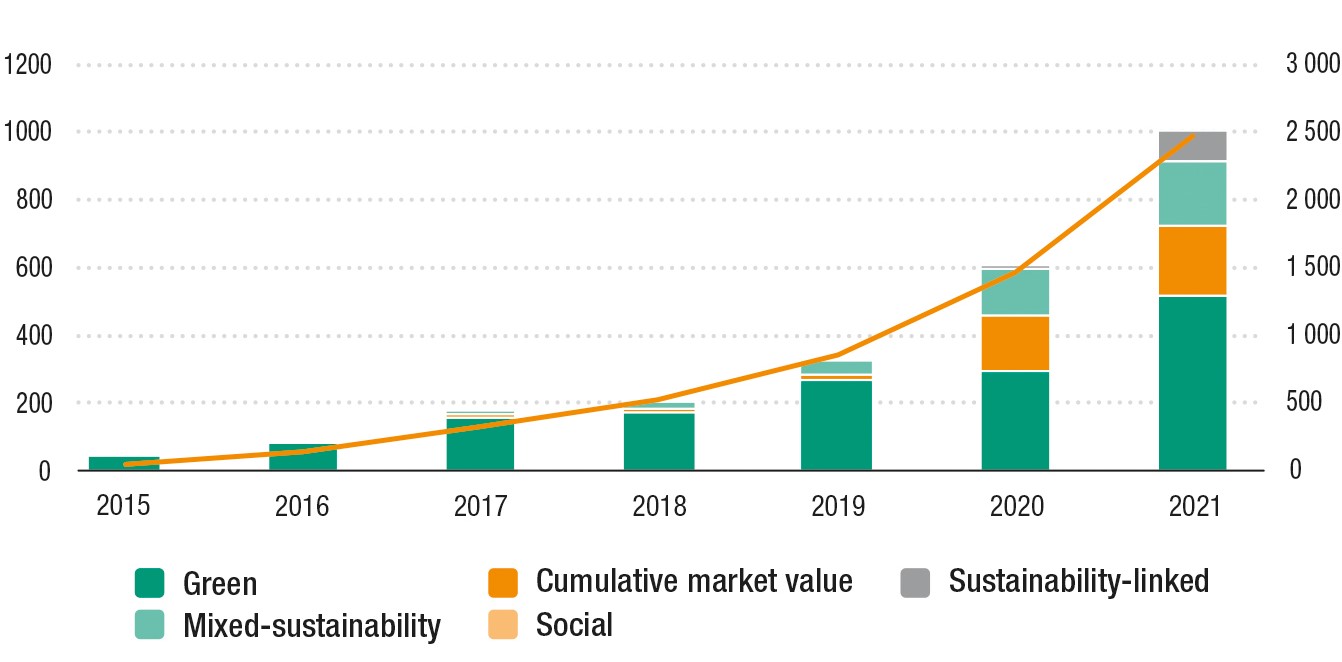

UNCTAD estimates the total value of sustainable financial products at $5.2 trillion, up by 63% from 2020. This includes $2.7 trillion of sustainable funds (Figure 1) and $2.5 trillion of sustainable bonds (including green, social and mixed-sustainability bonds) (Figure 2).

“The growing importance of sustainable finance is not just a question of market growth and expanded interest in related investment opportunities,” said James Zhan, director of UNCTAD’s investment and enterprise division.

“It is also about how to mainstream sustainability into the culture and business practices of investment and make capital markets work better for sustainable and inclusive development.”

Figure 1: Number of sustainable funds and assets under management, 2010-2021

(Number of funds, r/h axis, and billions of dollars, l/h axis)

Source: UNCTAD based on Morningstar data.

Figure 2: The $2.5 trillion sustainable bond market continues growth in 2021

(Billions of dollars)

Source: UNCTAD based on data from Environmental Finance and Climate Bonds Initiative

Sustainable finance remains meagre

However, the sustainable fund market represents just 4% of the total global fund market, and questions remain about the sustainable credentials of some funds.

For example, although some sustainable funds are fossil-fuel-free by prospectus, they are actually not so.

About 25% of self-declared green funds have an exposure of more than 5% to fossil fuels, and in some cases nearly 20%, which calls into question the “greenness” of these funds.

A major concern is that most institutional investors still don’t disclose or report on sustainability-related risks and are not moving quickly enough to reorient portfolios, especially with regard to climate-related action.

“Investors should take urgent action to decarbonize their portfolios and engage investees, while financial markets should accelerate the integration of sustainability disclosure,” Mr. Zhan said.

National regulations growing

The report highlights the growth in national regulations, following a phase of innovation and uptake of voluntary measures and standards by the capital markets.

Over 40% of sustainable finance-dedicated policy measures and regulations were introduced in the last five years, and 13% were adopted in 2021 alone, reflecting the accelerating pace of sustainable finance policymaking.

At the company level, mandatory environmental, social and governance (ESG) reporting has also been on the rise in recent years, supported by both exchanges and securities market regulators.

The number of exchanges whose issuers are covered by mandatory rules on ESG disclosure, currently 30, has more than doubled in the past five years.

“In order to build a viable ecosystem for sustainable finance to flourish, the entire investment value chain needs to be involved,” Mr. Zhan said. “This includes institutional investors, issuers, market intermediaries and companies, as well as regulators and stock exchanges.”

UNCTAD is committed to working together with key stakeholders from public and private sectors to maximize the financial market’s contribution to sustainable development, including the achievement of the Sustainable Development Goals.

Source:

https://unctad.org/news/regulation-rising-financial-markets-tackle-climate-risks

نظر: